- +1-315-215-1633

- sales@thebrainyinsights.com

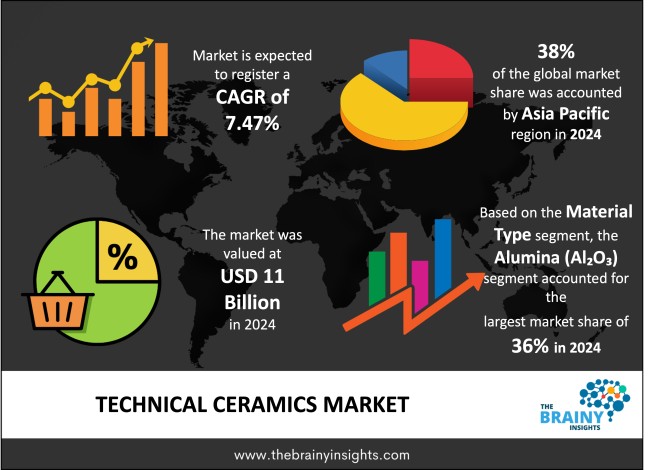

The global technical ceramics market was valued at USD 11 billion in 2024 and grew at a CAGR of 7.47% from 2025 to 2034. The market is expected to reach USD 22.60 billion by 2034. Technological advancements will drive the growth of the global technical ceramics market.

The group of materials known as technical ceramics or advanced ceramics or engineered ceramics includes ceramic materials designed to exceed standard mechanical performance together with thermal, electrical and chemical properties. The performance-driven applications of technical ceramics surpass traditional ceramics used in decorative or construction applications due to their industrial purposes within aerospace, electronics, automotive, medical fields and the energy sector. Manufacturers produce technical ceramics from highly purified materials that include alumina (Al₂O₃) with zirconia (ZrO₂), silicon nitride (Si₃N₄) alongside silicon carbide (SiC). Technical ceramics are produced by first creating ceramic powders after which shaping takes place by pressing, extrusion or injection molding followed by heat treatment under high temperatures to form dense microstructures. Technical ceramic substances demonstrate superior hardness properties together with high resistance toward high temperatures and impressive ability to withstand corrosion and wear damage with minimal thermal conductivity rates. The electrical versatility forms a substantial advantage among the characteristics of technical ceramics. The chemical stability feature of these ceramics enables their effective usage when working within chemically aggressive environments during chemical processing and semiconductor manufacturing operations. Research in ceramic matrix composites together with nanostructured ceramics has resulted in major improvements of their mechanical properties and resistance to fracturing.

Get an overview of this study by requesting a free sample

Technological advancements – The superior properties of these ceramics include superior hardness, exceptional thermal resistance, electrical insulation, chemical inertness along with outstanding wear resistance properties that make them suitable for high-performance applications in different industries. The structural integrity of technical ceramics remains stable in harsh operating conditions including extreme temperatures, corrosive conditions and high mechanical stress which improves system durability and cuts down maintenance expenses in critical systems. The biomedical applications of alumina and zirconia ceramics benefit from their stable chemical composition as well as their biocompatible nature which makes them ideal for medical implants and surgical tools due to their critical safety requirements. The internal value proposition of these materials receives enhanced benefits because of recent technological improvements. The development of ceramic composites with nanoceramics has improved mechanical performance characteristics including toughness as well as flexibility by resolving brittleness which is a traditional shortcoming of conventional ceramics. The recent technology advances both generate new possibilities for technical ceramics applications and support cheaper mass manufacturing which boosts commercial use.

High production expenses – The main disadvantage lies in their high production expense. The manufacturing expenses of technical ceramics increase steeply due to their need for pure raw materials combined with their energy-consuming advanced sintering technology. The manufacture of technical ceramics produces elevated costs that reduces their price performance relative to standard materials in cost-conscious markets. Technical ceramics exhibit structural weakness under tense loading conditions even after modern manufacturing progress because they remain brittle in impact scenarios. The manufacturing process for technical ceramics features complex operational limitations. Specialized equipment together with lengthy processing times increases both the production timeline and hampers manufacturing scalability. Once ceramics complete the sintering process their manufacturability turns into an enormous challenge because complex reprocessing proves inefficient and extremely costly. Production processes that need frequent design modifications are negatively affected by the lack of flexibility in technical ceramics. Technical ceramics present difficulties for seamless integration with other materials because they do not join easily for multi-material assembly needs.

Rapidly advancing world economy – The electronics and semiconductor industry is growing at a rapid pace serves as a primary factor behind increasing market demand. Technical ceramics meet all essential requirements for modern electronic industries since they provide perfect thermal management along with electrical insulation properties and durability. Electric and hybrid vehicle development in the automotive sector depends on technical ceramics for sensors along with battery parts and heat-resistant components. Healthcare needs for advanced medical procedures together with increased population of elderly patients drive the rapid adoption of ceramic materials for dental implants and diagnostic tools and joint replacement applications. Materials specifically designed for aerospace and defence usage heavily depend on ceramics because these materials demonstrate superior performance in harsh high-temperature and pressures along with corrosive surroundings.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. Asia Pacific emerged as the most significant global technical ceramics market, with a 38% market revenue share in 2024.

The regional dominance in technical ceramics production belongs to China, Japan and South Korea alongside India. China leads as the largest producer and consumer. Industrial growth together with the position of being a worldwide manufacturing centre has driven up technical ceramic demand across electronics, automotive and construction industries in the country. China’s electronics sector expansion combined with semiconductor leadership between Japan and South Korea drives massive material demand for alumina zirconia and silicon carbide because these materials deliver essential properties such as electrical insulation and high thermal conductivity alongside mechanical strength. The demand for technical ceramics has increased in India due to its developing electronics production facilities along with rising investments in healthcare technology. The Asia-Pacific region leads the technical ceramics market because it possesses affordable manufacturing practices together with qualified employees and state-of-the-art technological capabilities. Technical ceramics will continue to lead the market from Asia-Pacific as industries there continue their innovative development process.

Asia Pacific Region Technical Ceramics Market Share in 2024 - 38%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The material type segment is divided into Alumina (Al₂O₃), Zirconia (ZrO₂), Silicon Carbide (SiC), Silicon Nitride (Si₃N₄), Ferrite and Others. The Alumina (Al₂O₃) segment dominated the market, with a market share of around 36% in 2024. Al₂O₃ (alumina) leads the technical ceramics market worldwide because of its remarkable combination of price effectiveness with excellent performance and vast application possibilities. The wide industrial implementation of alumina ceramics happens because they demonstrate superior mechanical strength and outstanding thermal stability and electrical insulation along with their cost-effectiveness. The manufacturing cost of alumina remains lower than most advanced ceramics thus it serves as the prime material selection for both commercial and manufacturing industries. Alumina provides essential compatibility properties that make it ideal for dental implants together with orthopaedic devices and surgical tools in medical applications. The strong market position of alumina is sustained by ongoing research in its manufacturing approaches that stimulates better characteristics and decreases production costs. As a material alumina offers advantageous performance in high-demand and budget-sensitive systems that ensures its top position in global technical ceramics markets.

The product type segment is divided into monolithic ceramics, ceramic coatings, ceramic matrix composites and others. The monolithic ceramics segment dominated the market, with a market share of around 38% in 2024. Technical ceramics composed of single materials dominate global markets because of their excellent performance capabilities combined with wide industrial applications and strong mechanical properties. The production and cost-effectiveness of monolithic ceramics remain superior to composite ceramics because they consist of a one-phase ceramic material system. Their predominance in the market stems from their outstanding characteristic of high strength alongside extreme hardness and remarkable resistance to thermal shock and both wear and corrosion effects. The exceptional properties of monolithic ceramics adapt them ideally to situations that require tough operating conditions. Monolithic ceramics are essential for biomedical applications because they ensure efficient dental implants and joint replacements as well as surgical tools due to their biocompatible nature and durable performance. The straightforward fabrication process combined with easy design enables industries to use them as a dependable yet budget-friendly solution. The technical ceramics market selects monolithic ceramics as its key product segment due to improved manufacturing techniques that maintain their industrial and commercial leadership through cost effectiveness and high-performance characteristics.

The application segment is divided into electrical & electronics, thermal, mechanical, environmental, biomedical and others. The electrical & electronics segment dominated the market, with a market share of around 37% in 2024. The Electrical and Electronics sector controls the global technical ceramics market because manufacturers need high-performance materials for their evolving electronic component requirements. The modern electronic industry depends on materials capable of managing heat and delivering electrical insulation as well as maintaining long-term reliability because electronic devices keep becoming smaller and more powerful while becoming more energy-efficient. Electronical insulation along with thermal resistance at high temperatures makes these materials critical components for electronic miniaturization applications. LED technology together with solar energy applications depend on ceramic materials which provide heat resistance along with durability during the cycles of thermal expansion and contraction. The introduction of 5G technology and electric vehicles increases the need for high-performance ceramics in components that need efficient power management along with high-speed data transmission in addition to reliability under extreme conditions. Technological ceramics will preserve their industry leadership because they supply basic properties crucial for advancing state-of-the-art technological applications.

The end-use industry segment is divided into electronics & semiconductor, automotive, medical, energy & power, aerospace & defense, industrial machinery and others. The electronics & semiconductor segment dominated the market, with a share of around 35% in 2024. The Electronics and Semiconductor industry establishes technical ceramics as its primary material requirement because these materials provide vital support for enhancing electronic component performance and miniaturization alongside higher efficiency. Technical ceramics including alumina zirconia and silicon carbide receive high value in this sector because they provide desirable properties like excellent electrical insulation along with high thermal conductivity and mechanical stability. Semiconductor devices depend on these materials since they produce crucial electrical insulation to improve the durability and prolonged operation of integrated circuits and other components. The manufacturing of smaller and faster and more energy-efficient chips becomes possible through the procurement of technical ceramics for substrates and insulators together with packaging materials. The drive for better device performance among smartphones and computers increases the market need for high-temperature ceramic materials that isolate electrical currents. The electronics and semiconductor industries adopt technical ceramics as fundamental components to fulfil the advancing requirements for reliable innovative high-performing devices that are small in size.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2024 | USD 11 Billion |

| Market size value in 2034 | USD 22.60 Billion |

| CAGR (2025 to 2034) | 7.47% |

| Historical data | 2021-2023 |

| Base Year | 2024 |

| Forecast | 2025-2034 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Material Type, Product Type, Application and End-Use Industry |

As per The Brainy Insights, the size of the global technical ceramics market was valued at USD 11 billion in 2024 to USD 22.60 billion by 2034.

Global technical ceramics market is growing at a CAGR of 7.47% during the forecast period 2025-2034.

The market's growth will be influenced by technological advancements.

High production expenses could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2021 to 2034. The Brainy Insights has segmented the global technical ceramics market based on below mentioned segments:

Global Technical Ceramics Market by Material Type:

Global Technical Ceramics Market by Product Type:

Global Technical Ceramics Market by Application:

Global Technical Ceramics Market by End-Use Industry:

Global Technical Ceramics Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

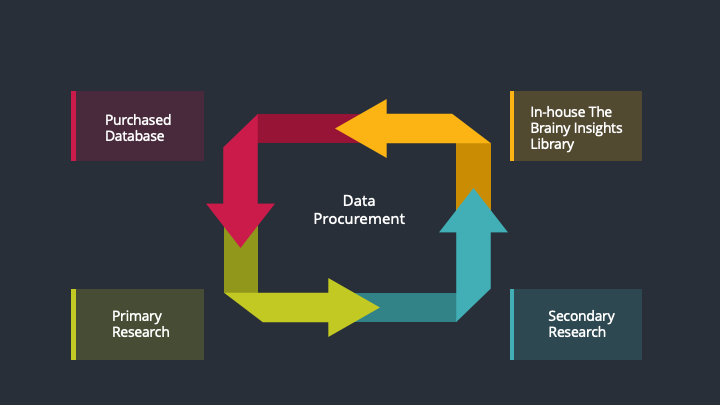

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

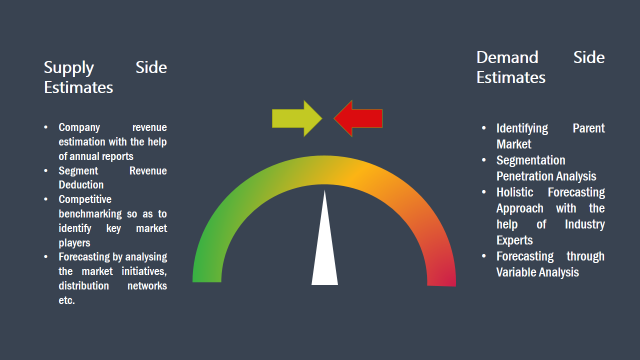

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date